The london energy efficiency fund leef was established by the mayor of london as the first dedicated energy efficiency fund in the uk.

Uk energy efficiency investments fund.

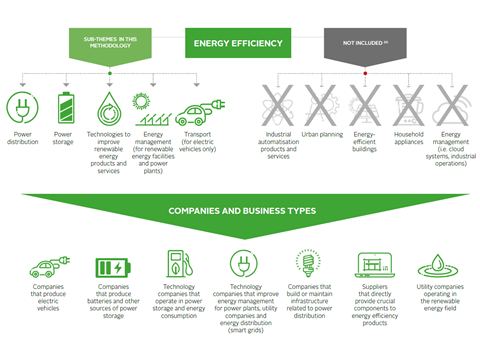

Objectives the fund aims at achieving energy efficiency gains for assets infrastructure in which it will invest delivering a minimum level of energy savings and receiving a commercial return on its investments.

However rishi sunak s pledge to fund a new energy efficiency plan with 3bn of spending is less than a third of the investment needed and its plans to install heat pumps will deliver less.

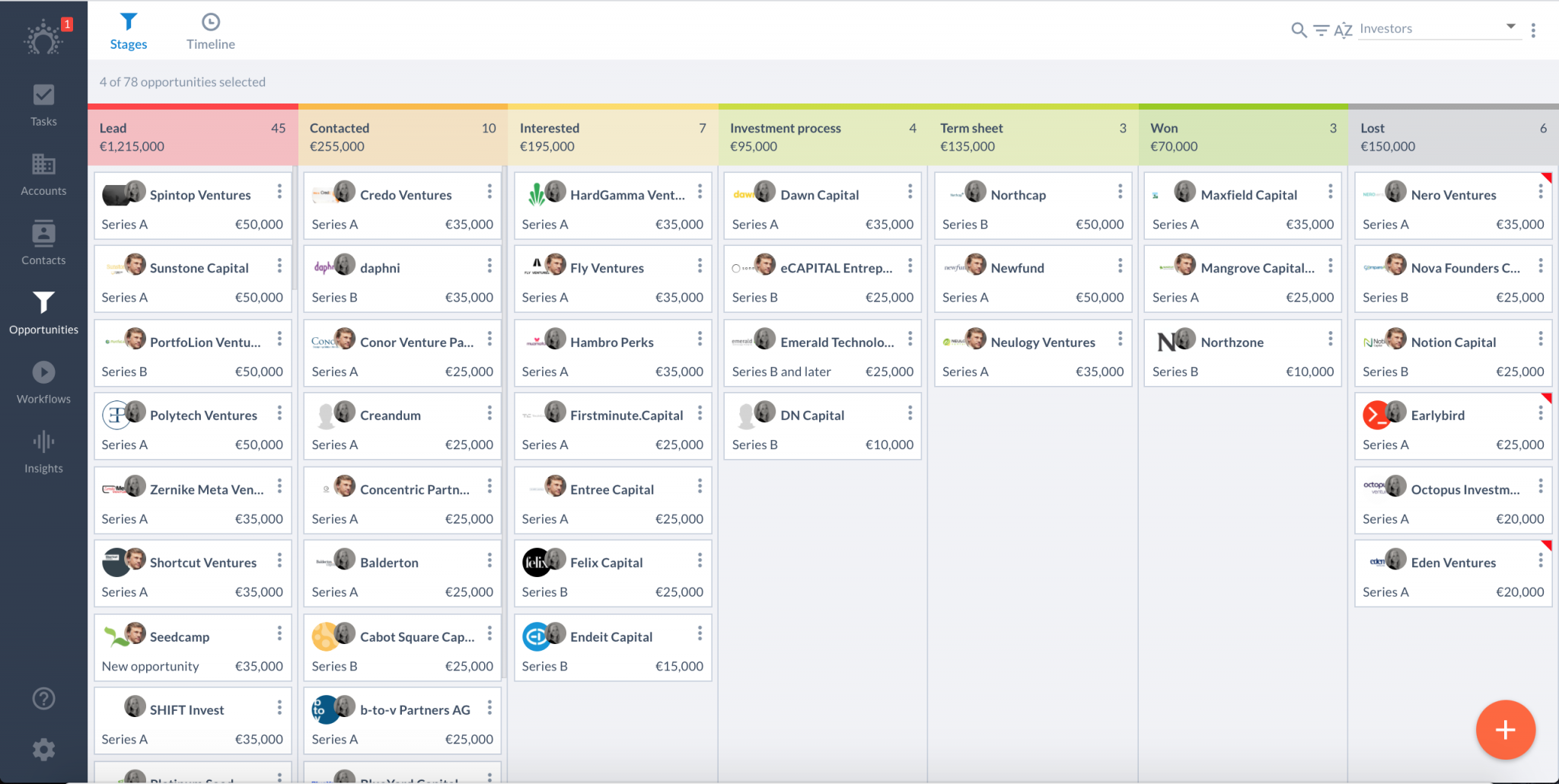

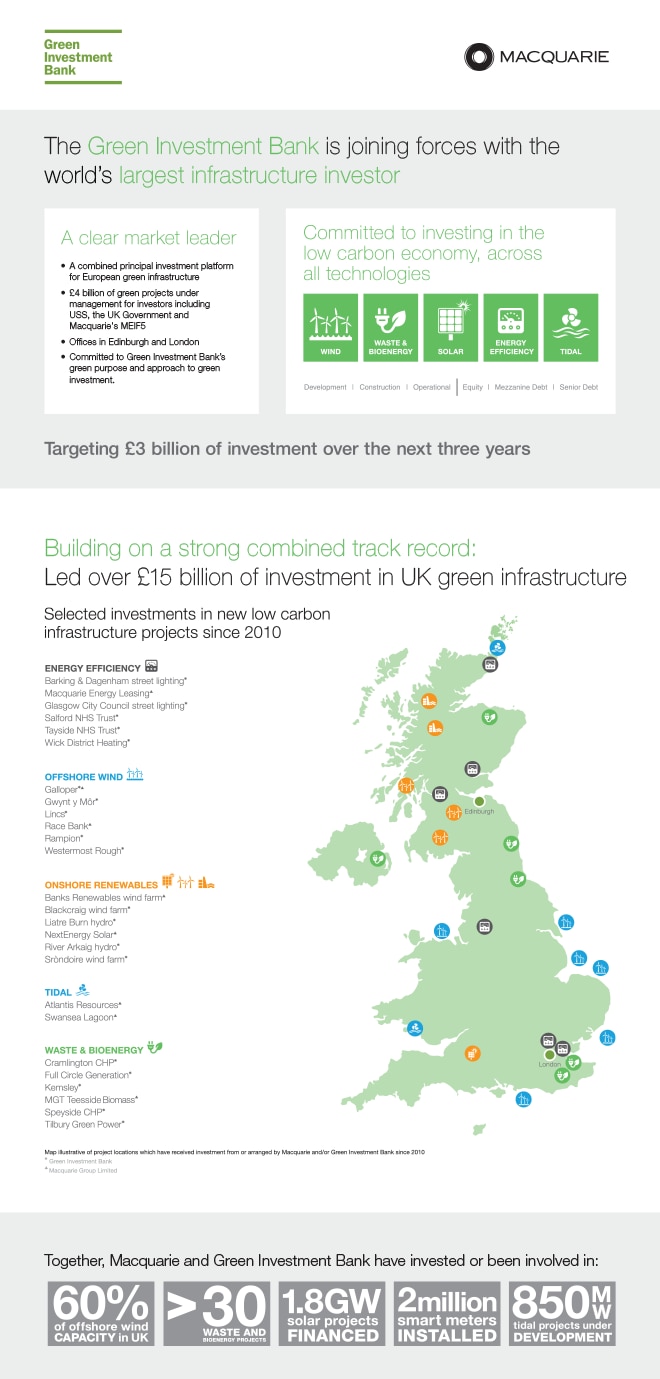

The fund was launched in 2012 and with the uk government s green investment bank gib as the cornerstone investor and a partner in promoting this sector.

The uk energy efficiency investments fund managed by sdcl is focused exclusively on energy efficiency project finance in the uk.

7 that it has exited the uk energy efficiency investments fund after the pool went public in december via a 100 million pound ipo.

The london energy efficiency fund leef has invested nearly 90m of capital and mobilised over 420m of external finance in innovative low carbon projects across london.

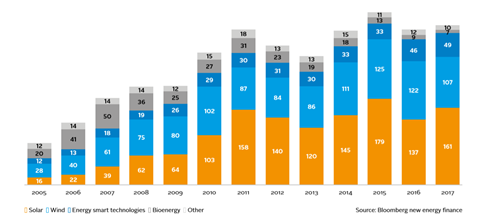

The uk government aims for 15 of our energy to come from renewable sources by next year.

The industrial energy transformation fund.

To cut their energy bills and carbon emissions through investing in energy efficiency and low carbon.

Other investors of the fund include green.

That means 85 of our energy needs will still come from non renewable sources though despite billions.

Ieef is advised by sdcl a leading global energy efficiency investment fund manager and advisor managing government backed investment funds in ireland uk us and singapore find out more how ieef operates.

Earth capital said feb.

The uk government announced 315 million of.

Many of these funds are considered specialty mutual funds and so carry higher than average expense.